On this page

Dotpay Casinos

On this page

Top rated casinos for players from Ohio:

Introduction

Online casino banking methods nowadays are much more diverse than they were a decade ago. Not only are there a whole new range of formats, but there are also so many more instances of each of them.

The older payment methods seem to have kept their market dominance, especially when it comes to credit card processing companies or cash transfer services. Banking institutions are known to introduce a novelty every now and then, but their services are mandatorily subject to rigorous investigation and verification, making them one of the most reliable payment methods anywhere.

Newer ones, however, are normally welcomed with some skepticism regarding their reliability. This is so due to the novelty of their company, their method of operations in processing payments, and the need to be certified by an existing authoritative body. Hence, many of these apply with the largest licensors or legal regulators, as well as testing institutions in order to provide proof of their reliability and attract customer traffic.

Nevertheless, in recent times...

... online casinos and gambling operators alike have been facing a different issue – that of compatibility. With so many existing and new types of online payment processing solutions, it is often a matter of choosing which ones can fit best on the website backend, and still remain unobstructed by each other. In fact, this has turned into one of the major issues of novel online casino establishments, resulting in a number of rejections, customer dissatisfaction and the likes.

In an attempt to resolve this problem...

... some financial companies have looked closely into the underlying issue, and ultimately come up with a solution. Nowadays, the latest payment services function as a unifying platform, or gateway if you will, of all the top popular payment methods invented so far. By handling integration into their optimized program, they eliminate the problem completely.

About Dotpay

The Dotpay company was established…

… in Poland back in 2001, and currently holds offices in both Krakow and Warsaw.

In that timeframe, they have managed to rise to prominence and rank themselves among the top payment processing firms in the country. For the most part, this is due to the solution’s unique and rather comprehensive way of operations, as well as their solid compliance with all legal and industry standards.

Basically, Dotpay is…

… a payment solution that functions as an overall gateway, allowing users to transact with a range of payment methods. It actually encompasses all the major existing, as well as new banking institutions and facilitators on its single platform, thus solving the merchants’ problem with integration.

How to Get Started?

The range of payment services it offers is still wide enough to get customers interested in trying out any methods other than their standard choice. All they’d have to do is follow the appropriate registration process of the specific payment processor.

What is more, customers will no longer need to search for e-commerce platforms, merchants and resellers that support their chosen banking option. Seeing Dotpay banking automatically indicates a selection of the top banking methods, with many more that can be included in the gateway service once they have been proven fair, secure and reliable.

So far, these are the top banking methods already included in the gateway solution:

- Banks – Most of the banking and financial institutions in the country have been included in this payment option, and even the few exceptions are still provided a way for their account holders to transact with Dotpay. All users need to do in order to make a payment using this option is to select from the list of partnering banks and continue with the online banking service they are already familiar with. Alternatively, they can choose to transact with a different bank by receiving a PIN or token from the gateway that will help identify their transaction, once it is completed and confirmed at their online banking service.

- Credit cards – The major credit card processors are also made available to Dotpay users, so they can choose how and when to use them. This kind of variety emphasizes the gateway’s dedication to successful money management. It includes Visa, MasterCard, Maestro, JCB, Electron, Diners Club /banking/cards/Diners/ and more. All they need to do is just input the card details – number, expiration date and CVV code and get the payment on its way.

- Cash – Even for those that are still reluctant to share any personal or banking information can choose this option. Simply print out a barcode or receipt number of your specific transaction and take it to the nearest authorized retail outlet. Their network is quite developed all over the country, making it as convenient as any other option.

- Mobile/web billing – With the rise of smartphone use, the ‘pay-by-phone’ banking method soon appeared. Telecommunication operators allow their customers to receive charges on their monthly phone bill or get credit out of their prepaid funds. T-Mobile was proclaimed as the first such operator to offer this service through Dotpay, with others following suit soon afterward – mPay and SkyCash.

- Paysafecard – Considering the rising popularity of these novel payment methods – e-wallets, prepaid cards and other online processors – the gateway ultimately included them in their list of options. Paysafecard is a prepaid option that has reached global popularity; it provides a prepaid solution for everyone who wants to avoid using their regular bank accounts or cards.

- PayPal – The older and recognized brands of online payment processors are just as present, as some customers tend to choose a method that has a longer track record. And with PayPal’s impeccable past, it practically made for an obvious choice when it comes to including it on the Dotpay payment gateway platform. However, due to the strict company policies and legal regulations it adheres to, users may need to seek out some of the other payment methods when settling charges from specific foreign platforms.

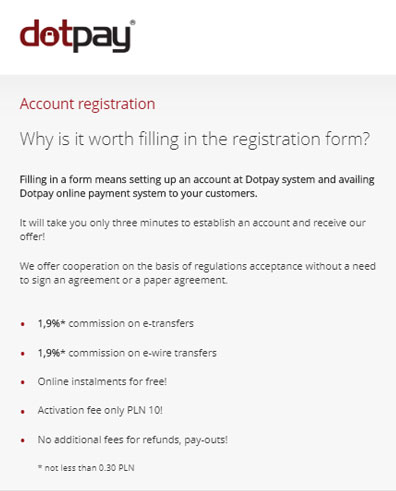

In order to make use of these and more payment methods provided by this gateway service, interested individuals need to sign up through a secure registration link. The same goes for any interested business establishments that want Dotpay as their payment processor.

All in all...

... once you select the profile of your account, you will only need to enter the personal information in the designated fields. These include full name, email, address and postal number, as well as an ID number of a Polish identification document. The last requirement directly specifies the pool of eligible users and limits it to registered residents of Poland. While this may be slightly discouraging for the international user pool, promising efforts are being made regarding expansion into other countries.

Still, Polish residents who are actually able to make use of the service will be able to benefit from a wide range of e-commerce platforms that feature this banking solution. It has ultimately become a popular option both among e-commerce establishments, and satisfied customers alike.

Dotpay Online Casino Banking Method

Interactive gambling companies make up for a significant portion of the Dotpay’s wide use as a payment gateway. After all, the choice of banking method has always constituted one of the key factors for player satisfaction, and their overall success.

This solution allows online casino operators, sportsbooks, poker, bingo rooms and lottery platforms to integrate the top popular banking methods, as mentioned earlier. Players in the industry are particularly inclined towards the payment options listed above, as they offer just the right balance between accessibility, convenience and most importantly, security.

Making Online Casino Deposits

Step 1: Anyone that wants to use this payment gateway for their online casino deposits will need to seek out a casino site that supports the solution. Considering that it is available for Polish players, the best place to start searching is among Poland-oriented operators. Nevertheless, those catering to an international audience are just as likely to adopt this optimal banking service. Make your pick from some of the casinos listed on this page (Play Frank, VegasBerry, Casino Ventura) or head to the banking page of your chosen operator.

Step 2: It shouldn’t take too long before you are able to find a good online casino that offers this kind of payment method. After all, most operators dedicated to prime banking maintain the same high standards regarding top game software, player-oriented offers and customer support. Just register at the casino or sign in with an existing account and head to the Cashier/Banking page.

Step 3: Select Dotpay once you’re there, and choose whichever method you’d like to pay with through this secure gateway. Depending on your choice, you will need to follow the specific procedure for making deposits, such as printing a receipt or logging into your online bank account, e-wallet and similar.

Step 4: Either way, once you’ve chosen and accessed the preferred method, enter the information, specify the amount and confirm the transaction. Dotpay conducts all payments from partnering methods through their unique payment gateway. While this may slightly delay the process due to redirecting, players should see their money available in the casino account in a matter of minutes.

Dotpay Withdrawals at Online Casino Sites

None of the casinos featuring this banking solution have so far offered withdrawals through its gateway. Bear in mind that the individual methods included have a varied approach to this, with online banking, cash transfer services and online payment processors the likes of PayPal and Paysafecard offering cashouts.

That way, even if the Dotpay banking gateway doesn’t change its policy in the future, you will still be able to use the top popular payment methods separately. As long as you are lucky enough to hit a major win that makes you impatient to withdraw your cash prize, you should be able to withdraw with an optimal payment method.

Pros

- Security – The service is fully secured and proven fair by the leading authoritative bodies and organizations in its field of work. More specifically, it has managed to meet all criteria of the Payment Card Industry Data Security Standard (PCI- DSS). What is more, they have been authorized by Thawte and the Polish Financial Supervision Commission. With all this in mind, it isn’t too strange that in about 15 years of active experience, they have managed to cover a full 20% of the market share in Poland and attract over 30k merchants into their partner scheme.

- Accessibility – The best part about its popularity is that Dotpay was soon accessible to everyone. More and more merchants are experiencing and proving the benefits of the gateway as they adopt it on their own respective platforms. And with the simple registration and interactive layout, there is nothing stopping potential customers from enjoying their banking experience with Dotpay.

- Dedicated Service – A focus on the market in Poland may be somewhat restrictive, but the bright side of it is that the service has been able to focus on a specific target group. Hence, residents playing at Dotpay online casinos or shopping at their retail partner platforms will are constantly greeted with improvements and optimized services.

- Low fee policy – The Dotpay.pl does charge a small fee, but this is simply a symbolic sum in comparison to the other top payment methods. And with the added convenience of having multiple choices fit into one gateway, it is an even smaller price to pay. Even at that, remember that the registration is free, so players will only get charged per transaction.

- All-in-one approach – This comprehensive approach is an innovation in itself, and helped distinguish the gateway in the front rows of payment services. Even if it isn’t a feature in itself, it has definitely contributed to the overall success.

Cons

- Processing speed – The same all-encompassing approach does have a minor glitch – some payment processing methods may perform a bit slower than usual. This is solely due to the fact they are using the payment gateway processing channel, and shouldn’t prolong the wait time for anything over a few minutes.

- Country restrictions – Dedicated service for Polish customers leaves all the rest standing interested in the sidelines. With most other banking solutions aiming towards a more global coverage, Dotpay is considered to be at a disadvantage for missing this feature.

Dotpay Casinos

Filter

More filters

If we have jumped the gun, you can remove that filter by clicking here.

FAQs

What are the amounts of the fee charges for using Dotpay?

The fee charge is set at a flat rate of 3.9% for transaction, with a minimum charge of 0.30PLN in case it’s a really small amount being transferred (less than 1PLN). Additionally, registration is free, but account activation will cost you a one-time charge of 10PLN.

Can the banking method be used internationally?

In theory, yes, Dotpay can be used on international e-commerce platforms, but is still limited to residents of Poland as its user base.

What is the customer support like for this banking solution?

Polish-speaking users get the prime treatment, while an English contact channel is not available 24/7. However, considering you don’t have an urgent matter, you could address your inquiry or complaint through email and get an answer back within the day, or contact their offices via phone or post in Krakow or Warsaw.

How long does it take for a transaction to get processed through Dotpay?

On average, it is estimated that transactions through this payment gateway shouldn’t take any more than 5 minutes.

What are some suitable alternatives for those ineligible to use the payment method?