On this page

The Kelly Criterion

On this page

Introduction

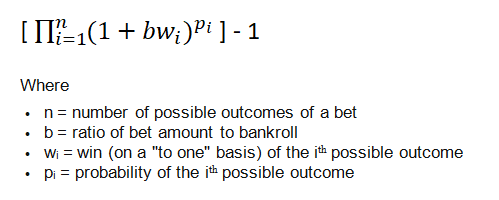

The Kelly Criterion is a bet-sizing technique which balances both risk and reward for the advantage gambler. The same principle would work for any investment with an expectation of being profitable. For the gambler/investor with average luck bankroll and a fixed bet size, the expected bankroll growth after one bet is:

For example, suppose a casino ran a promotion in craps where the 2 paid 3 to 1 and the 12 paid 4 to 1. A 3, 4, 9, 10, or 11 still pay 1 to 1 and every other total loses. The probability of a 2 or 12 is 1/36 each, of any even money win is 14/36 and of a loss is 20/36. Suppose also the player bets 1% of his bankroll every bet. Then the expected bankroll growth per bet would be:

(1 + (0.01*3))^(1/36) * (1 + (0.01*1)^(14/36) * (1 + (0.01*-1))^(20/36) * (1 + (0.01*4))^(1/36)) - 1 = 0.00019661.

This product is maximized by Kelly betting. Kelly betting also minimizes the expected number of bets required to double the bankroll, when bet sizing is always in proportion to the current bankroll.

The Kelly bet amount is the optimal amount for maximizing the expected bankroll growth, for the gambler with average luck. While betting more than Kelly will produce greater expected gains on a per-bet basis, the greater volatility causes long-term bankroll growth to decline compared to exact Kelly bet sizing. Betting double Kelly results in zero expected growth. Anything greater than double Kelly results in expected bankroll decline. What is more commonly seen is betting less than the full Kelly amount. While this does lower expected growth, it also reduces bankroll volatility. Betting half the Kelly amount, for example, reduces bankroll volatility by 50%, but growth by only 25%.

For simple bets that have only two outcomes, the optimal Kelly bet is the advantage divided by what the bet pays on a "to one" basis. For bets with more than one possible outcome, the optimal Kelly wager is that which maximizes the log of the bankroll after the wager. However, for bets with more than one outcome, that can be hard to determine. Most gamblers use advantage/variance as an approximation, which is a very good estimator. For example, if a bet had a 2% advantage, and a variance of 4, the gambler using "full Kelly" would bet 0.02/4 = 0.5% of his bankroll on that event. Remember that variance is the square of standard deviation, which is listed for many games in my Game Comparison Guide.

Ohio Recommended Online Casinos

View All

Ohio Recommended Online Casinos

View All

Let’s look at three examples.

Example 1: A card counter perceives a 1% advantage at the given count. From my Game Comparison Guide, we see the standard deviation of blackjack is 1.15 (which can vary according to the both the rules and the count). If the standard deviation is 1.15, then the variance is 1.152 = 1.3225. The portion of bankroll to bet is 0.01 / 1.3225 = 0.76%.

Example 2: A casino in town is offering a 5X points promotion in video poker. Normally the slot club pays 2/9 of 1% in free play. So at 5X, the slot club pays 1.11%. The best game is 9/6 Jacks or Better at a return of 99.54%. After the slot club points, the return is 99.54% + 1.11% = 100.65%, or a 0.65% advantage. The Game Comparison Guide shows the standard deviation of 9/6 Jacks or Better is 4.42, so the variance is 19.5364. The portion of bankroll to bet is 0.0065 / 19.5364 = 0.033%. By the way, this exact promotion is going on at the Wynn as I write this, for September 2 and 3, 2007.

Example 3: A sports wager has a 20% chance of winning, and pays 9 to 2. The advantage is 0.2×4.5 + 0.8×-1 = 0.1. The optimal Kelly wager is 0.1/4.5 = 2.22%.

Following is the exact math of example 3. Let x be optimal Kelly bet, with a bankroll of 1 before the bet. The expected log of the bankroll after the bet is...

f(x) = 0.2 × log(1+4.5x) + 0.8 × log(1-x)

To maximize f(x), take the derivative and set equal to zero.

f'(x) = 0.2 × 4.5 / (1+4.5x) - 0.8 / (1-x) = 0

0.9 / (1+4.5x) = 0.8/(1-x)

0.9 - 0.9x = 0.8 + 3.6 x

4.5x = 0.1

x = .1/4.5 = 1/45 = 2.22%

The math gets much messier when there is more than one possible outcome, such as in video poker. The method is still the same, but getting the solution for x is harder. The easiest way to solve for x in such cases, in my opinion, is experimenting with different values, using the higher and lower techniques (like the Clock Game on the "Price is Right"), until the f'(x) gets very close to zero.

I did this for two common video poker games with greater than 100% return. For "Full Pay Deuces Wild," with a return of 100.76%, the optimal bet size is 0.0345% of bankroll. For " 10/7 Double Bonus," with a return of 100.17%, the optimal bet size is 0.0062637% of bankroll. I have heard a rule of thumb that to make it in video poker you should have a bankroll of 3 to 5 times the royal amount you play for. If playing Full Pay Deuces wild, the exact amount is 3.66 royals. For 10/7 Double Bonus it is 19.96 royals.

Simulations

To prove my statement that Kelly minimizes the number of bets to double the bankroll I assumed an even money bet with a 51% chance of winning, for a 2% advantage, and 2% Kelly bet size. Here is how many bets were required on average to double the bankroll at various bet sizes. If a winning wager would put the bettor over double the bankroll, he would only bet what was needed to exactly double the bankroll.

Average Bets to Double Bankroll

| Bet Size | Average Bets |

|---|---|

| 0.5% | 7,901 |

| 1% | 4,617 |

| 2% | 3,496 |

| 3% | 4,477 |

Kelly Vs. Optimal Video Poker Strategy

In my Sep. 20, 2007 Ask the Wizard column I suggested the Kelly bettor should sometimes not play optimal video poker strategy. My reasons are explained there.

Ohio Recommended Online Sports Books

Ohio Recommended Online Sports Books

Links on Kelly

Fortune’s Formula by William Poundstone. Read my review.

Casino Gambling for the Winner

A good source on Kelly, especially as it pertains to blackjack, is Blackjack Attack by Don Schlesinger.

The Kelly Criterion at Wikipedia.