On this page

SwiffyEFT Online Casinos

On this page

Top rated casinos for players from Ohio:

South African players playing across online casinos can rarely find a decent payment method to use, but SwiffyEFT comes to their rescue. This is an electronic funds transfer solution that was designed in the country for South African users, providing them with rather convenient, above all secure, and pretty cost-efficient transactions. As such, it was accepted by the online gambling industry and is now offered by some of the greatest South African and global online casinos accepting players from the region. Why choose SwiffyEFT as your online casino payment method?

About SwiffyEFT

As introduced, SwiffyEFT was gladly accepted by the online gambling industry, and there are three reasons why. The solution appeared and solved three problems global casinos were facing previously when it comes to catering to their South African players. First, with it, players can transact using their own country’s currency, the South African rand. With that, they do not need to pay unnecessary currency conversion fees. Secondly, the solution processes transactions online with the speed of light, instantly. This is a great plus, something both players and operators want. And thirdly, and most importantly, with it, players can play across online casinos even though they may not have or do not want to share credit cards with the operator.

As introduced, SwiffyEFT was gladly accepted by the online gambling industry, and there are three reasons why. The solution appeared and solved three problems global casinos were facing previously when it comes to catering to their South African players. First, with it, players can transact using their own country’s currency, the South African rand. With that, they do not need to pay unnecessary currency conversion fees. Secondly, the solution processes transactions online with the speed of light, instantly. This is a great plus, something both players and operators want. And thirdly, and most importantly, with it, players can play across online casinos even though they may not have or do not want to share credit cards with the operator.

These are basically the things every South African player dreams of, speed, convenience and unrivalled privacy. So, how does the solution manage to provide users with these perks? Well, this is a third-party financial service, an electronic funds transfer solution, that works closely with banks in order to make online banking more convenient for you. It has partnered with some of the leading banks in the country:

- Nedbank

- Old Mutual Bank

- Standard Bank

- First National Bank

- Capitec Bank

- Tyme

- Standard Bank

- Bidvest Bank

- ABSA Bank

- African Bank

- Investec

With that, it has managed to offer users the third-party service of their dreams. But, believe it or not, the solution was launched just months ago, in 2020, trying to modernize and make online banking way easier and more convenient for users. As such, it immediately attracted businesses, merchants and users, since it had some of the major banks behind it, as well as their security measures.

Not long after it was launched, it started getting offered as a payment method across online casinos. In fact, it quickly became one of the most used and most preferred solutions by South African players, who were incredibly satisfied with its fast and secure online payments service. Therefore, if interested in knowing how to use it and where, stay with us.

Getting Started with It

As mentioned, you don’t need to have a credit card to use SwiffyEFT freely, wherever you want. This is a solution that is closely working with banks, though, so you would need to have a bank account with one of the partnered banks. This is actually the only prerequisite you need to meet in order to start using it.

As mentioned, you don’t need to have a credit card to use SwiffyEFT freely, wherever you want. This is a solution that is closely working with banks, though, so you would need to have a bank account with one of the partnered banks. This is actually the only prerequisite you need to meet in order to start using it.

As long as you have a bank account with one of the leading partnered South African banks, as listed above, you’re good to go. Since it is based on the Electronic Funds Transfer system in the country, it can actually help you move money pretty much to any place across the globe, but most importantly, do it using your own currency, the rand.

And since it is based on the EFT system, you don’t even have to create any separate accounts to use it. All you’ll need to do to request a transaction via it is choose it as your payment method, and just fill out the necessary details to complete the transaction, to be explained shortly.

Now, we must mention here that the EFT service is not the only service the solution offers. If you explore Swiffy’s official website, you’ll see that the solution also offers four others. There’s a cool service called SwiffyPay, which allows you to send money via WhatsApp, SMS or email using InstantEFT, their credit or debit card. But, there are also services meant for merchants and business owners, such as SwiffyBenefits, SwiffyCX and SwiffyBot.

How to Deposit at Online Casinos with SwiffyEFT?

Sure, SwiffyEFT is a rather new online payment solution, launched in 2020, but as we said, it has already achieved huge success across the online gambling industry. In fact, as mentioned, it is already listed as one of the top methods for South African players, so you can rest assured that all premier South African casinos will be offering it as an option.

So, what you need to do first is to find a suitable South African casino for you to join. Register an account with it, and then, you can proceed to make a deposit:

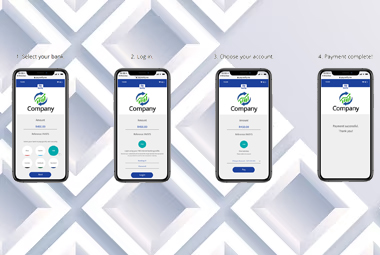

- Go to the casino’s Banking/Payments/Cashier page.

- Find SwiffyEFT’s logo and click or tap on it.

- In the new window, enter the amount of funds you’d like transferred to your casino balance.

- Select your bank from the ones listed (the partnered banks).

- Log into your online banking profile to pay quickly and securely.

- Select the account you’d want to use for the transaction to be completed.

- Click on the Pay button and you'll have confirmed your request.

- The money will arrive in real-time on your online casino balance!

How to Withdraw Winnings with It?

As you could see, deposing with SwiffyEFT is pretty straightforward and quick, and so is withdrawing with it, as you’d basically need to go through the same steps.

After you choose it from the listed methods and choose your bank from the ones offered, you’d need to log into your online banking profile again, select the account where you’d like the money to land and specify the amount of money you’re requesting to receive from the casino.

The casino will need to review your request, check whether you have enough funds to withdraw, and as soon as it approves it, SwiffyEFT will transfer your winnings to the desired account. This entire process may take 24 to 48 hours, though, but not because of the solution, but because the casino might need some time to thoroughly vet your request and check whether you have any bonus Terms and Conditions left unmet before it approves it.

Fees and Limits

We mentioned earlier that SwiffyEFT is really cost-efficient and convenient to use. But that doesn’t mean that it does not charge fees at all.

It means that these fees are really symbolic, and for certain services only. For using the basic services, meaning for depositing and withdrawing across online casinos, you won’t need to pay fees! But, if you’re using other services like SwiffyChat, you’d need to pay a monthly fee of ZAR699. If using the SwiffyPay service, a monthly fee of ZAR399 will be charged. But if you’re using the basic SwiffyEFT, the EFT service, your transactions will actually be fee-free!

Allowed and Restricted Countries

It should be clear to you by now that South Africa is the only one on the allowed countries list, and all other countries across the globe are on the restricted countries list. This solution was designed to serve South African users, with accounts across South African banks, so if you're a player from any other country, you won't be able to use it.

It should be clear to you by now that South Africa is the only one on the allowed countries list, and all other countries across the globe are on the restricted countries list. This solution was designed to serve South African users, with accounts across South African banks, so if you're a player from any other country, you won't be able to use it.

And even as a South African player, you would need to provide proof that you’re a resident of the country, and you need to have a bank account with one of the partner banks. If all is in order, you can use it, with no obstacles.

Available Currencies

We did mention at the beginning the fact that one of the best things about SwiffyEFT is that it allows South African players to play across online casinos with their own country’s currency.

And considering what you’ve read so far, it is probably clear to you by now that the South African rand is the only accepted currency. But you are probably glad it is since you'll avoid paying currency conversion fees when playing at online casinos where the South African rand is a default currency or at least a currency option!

FAQs

Is the solution by any chance available in English?

Yes, indeed. If you’re trying to explore all the perks it can offer, you can do it in English, as its platform is available in English because it is one of the many official languages in the country. Plus, it is the language used for state and parliamentary discourse in the country.

Is it possible to use my credit card instead of a bank account to pay through the service?

Well, in theory, yes, but only if you’re using the SwiffyPay service. SwiffyEFT, as implied by its name, uses the bank EFT system, so the transfer must go through your bank account.

Is it an option to use a different currency, even at a cost of a currency conversion fee, or only ZAR?

ZAR is your only currency option, given the fact this is a solution created in South Africa, for the South African citizens, by a South African company.

Can I use my smartphone to request a transaction with it?

Sure, why not? As long as you’re playing at an online casino that is compatible with mobile devices, you can choose SwiffyEFT as your payment method, and via the browser, request your transaction. If using the SwiffyPay option, you can use your phone to deposit at the online casino via SMS, email or WhatsApp, too!

How can I be sure that this is a safe payment method?

In addition to collaborating with the leading South African banks and using their security measures, SwiffyEFT implements high-end PCI-DSS standards to ensure that all your sensitive details are secured. This means that all the data exchange between your device and the solution is encoded.