On this page

QuickPay Casinos

On this page

Top rated casinos for players from Ohio:

Introduction

Online transactions are getting more and more sophisticated, as payment facilitation companies are constantly working hard to improve their services. This is no surprise, considering the many ways in which competition has increased.

Nowadays, payment processing services...

... are practically bound by certain market standards. This includes security, authorization, legal compliance with specific jurisdictions, as well as speed, convenience and easy integration of their payment solutions. While there are so many online payment solutions that meet these requirements, it is the additional functionalities featured in specific methods that set them apart from the rest.

One set of service providers tend to focus on security...

... while others allow greater customization according to user preferences. In the same way, services often choose between a dedicated local user pool and a more international target audience, and adapt their product offering accordingly.

Personal preferences...

... should always be taken into account all the while, although it wouldn’t hurt interested users to research some more on the company before entering into any user agreement. In this regard, user and expert reviews make all the difference, so make sure to pay attention to the features, functionalities, pros and cons in order to choose the best for your online payment needs.

About QuickPay

One of the more modern payment methods that have entered the e-commerce industry this century is QuickPay. The company made a name for itself thanks to their specific way of doing business, which is often mentioned among satisfied customers.

Officially speaking, QuickPay is a payment service company...

... acting somewhat as the ‘bank terminal on the Internet’, as they like to put it.

Their official website speaks of a professional service, and this is further proven by their impeccable track record since December, 2004. The company first started out as an urge of a few driven tech experts looking to master specific difficulties that inconvenienced online payments for merchants and customers alike.

Today, the company boasts...

... of more than 30.000 customers, with 2.000.000+ payments being processed per month. Yet, they remain driven by their desire to improve and optimize the user experience rather than simply run a business.

How to Get Started?

The company offers its interested clients a specialized page on getting started with the service. Here, you will be able to find all the details about your e-commerce platform, acquirers, and the way QuickPay fits into all this.

The first thing...

... you will need to determine if you are interested in using QuickPay is an e-commerce platform. This service informs all potential clients of their API, as well as specific integration platforms, including system modules, hosted systems and partnering services alike.

Another guideline to follow...

... is the choice of acquirer – the financial institution that will be in charge of transacting the funds from one account to another. Variety of choice is largely available in this regard as well, with some of the top brands including Klarna, Paysafecard, PayPal, Swish, Coinify, Nets and more.

Ultimately...

... the guide introduces interested users to QuickPay, considering you have determined the shopping solution you will integrate with and the financial service in charge of your account. In this regard, both merchants and their clients should be aware of QuickPay’s role – the service collects the payment information from the merchant’s customer, and sends them to the acquirer.

Considering that QuickPay is not...

... a single payment method, but rather a whole platform solution, it is only natural that it includes a range of options for customers to choose from. Specifically, the customers at merchant sites that use QuickPay’s banking solution will be able to choose from:

- Visa

- MasterCard

- Dankort

- Maestro

- JCB

- American Express

- Diners Club

- ForbrugsForeningen

- Resurs Bank

- ViaBill

- Vipps

- Swish

- Bitcoin

- Trustly

- iDeal

- Klarna – Pay now

- Klarna – Pay later

- PayPal

- MobilePay

- ApplePay

- Paysafecard.

This means that shoppers, casino players and other online customers alike, holding an account with any of the above-listed financial institutions will be able to use their respective funds for payments at any merchant featuring QuickPay.

They benefit from an added layer of transaction security, as well as convenience, while merchants get a fully equipped banking page by partnering with a single company.

Online customers, shoppers and players included, consider...

... the choice of available payment methods as a key factor to adopting or rejecting a certain merchant. This solution specifically allows merchants to offer all the mentioned methods, qualifying them for even the pickiest of customers. Hence, you could say that aside from a banking solution, QuickPay additionally serves its merchant partners as a customer acquisition tool.

On a final note...

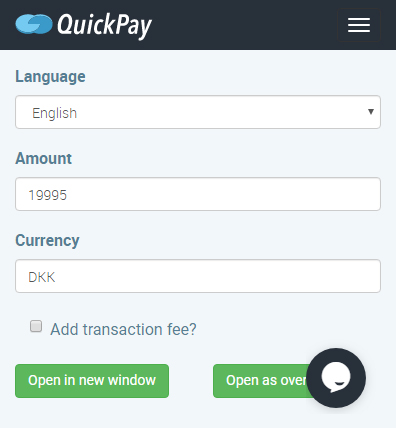

... there is one more thing to be aware of when getting started with this payment solution – its pricing structure. The company has a low-fee policy, as is evident especially from its test-run period. Those signing up for a trial version get the standard solution completely free of charge, with the payment processing functionality charging €1 per transaction.

Otherwise, interested merchants looking to integrate...

... this payment solution in their online shop will be able to do so through a subscription plan. The Starter package is available for €10 a month, and a €0,2 for a single transaction, while the Professional level pack comes for €25 monthly fee, but a €0,1 fee per transaction. Merchants may be additionally charged for adding another domain or branding the payment window, as well as the fully functional Mobile Pay and Apple Pay mobile device solutions.

QuickPay at Online Casino Sites

All the while, these charges and obligations are followed through and obeyed by the respective merchants rather than their customers. For online casinos specifically, this means that operators handle the technicalities, while their online casino players enjoy prime banking options through the single platform.

Consequently...

... QuickPay has become a popular choice among the top casino operators looking to automate their entire banking page under a single service. Learning how to use it is a simple process, considering you are already familiar with making payments using your regular preferred method.

Making QuickPay Online Casino Deposits

Step 1: Most online casinos offering payments through this comprehensive solution will state that straight from the homepage. However, in case you can’t find the brand straight up, head to the banking section and make sure it is available. This will mean that players registered play at the casino will be able to use all the above-listed payment methods through the QuickPay solution.

Step 2: If you have made sure it is available, complete the quick registration form and enter your player account. Head straight to the banking page and choose QuickPay. Those interested in transacting with their plastic cards will choose from the specific card companies (AmEx, JCB, Maestro,...) and input their card details – holder name, card number, expiration date and code.

Step 3: Additionally, they will need to input the personal code, as sort of a password that is linked to their card in order to confirm their identity. This, in fact, is part of the greater anti-fraud and ID protection measures incorporated in the payment solution platform in order to ensure their users’ security at all times.

Step 4: Otherwise, choosing to pay with an account you have with one of the e-wallets or mobile pay wallets will ask you to input the login details suitable for your chosen method. Ultimately, just specify the amount you would like to transfer to your online casino account and confirm the transaction.

Before you know it, QuickPay will make the link between your authorization and the merchant’s acquirer, facilitate the funds transfer and result in nearly instant debiting of your player account. Just head over to the game library or bonus section, make your pick and enjoy some real money casino action.

Requesting Withdrawals from QuickPay Online Casinos

Should the respective online payment method offer the functionality on its own, QuickPay will additionally allow users to process cashouts from their casino accounts. The procedure is performed much the same way, with QuickPay being the relation between the customer’s payment request on the merchant platform, and the merchant’s acquirer.

QuickPay Online Casino Advantages

- Availability – The service has been largely beneficial to its user pool, which is why it has been able to expand and cater to an even greater audience. Nowadays, it is available in almost 20 different languages, catering to users globally – Denmark, UK, Germany, Estonia, France, Faroe Islands, Hungary, Latvia, Lithuania, Netherlands, Norway, Poland, Finland, Sweden and Austria.

- Security – Something has been mentioned in regard to the security maintained at QuickPay, but looking it in further details truly allows users to appreciate the level of protection. For one, it is certified for the latest version of PCI DSS Level 1, meaning it performs regular checks and subjects to strict requirements.

Additionally, the service partners with the available payment methods to provide a unique 3-D Secure standard whenever possible. So far, card holders from top credit card companies – JCB, Visa, MasterCard – have an extra password for verification purposes. The anti-fraud measure Fraud Fighter also contributes to QuickPay users’ security.

- Integration – With all the functionalities, anyone would think that integrating this payment solution is as complex as it gets. However, the simple and well-built API, as well as its specific SDKs for mobile merchants makes it a suitable option for anyone willing to invest in it.

- Fees & Pricing Policy – Speaking of investing in the service, QuickPay is quite affordable for its wide functionality. This is due to its subscription pricing plan that allows merchants to maintain partnership for as long as it is beneficial. All the while, individual customers are not being charged anything, which makes it all the more attractive for e-commerce platforms looking to bank much more customers thanks to this characteristic.

- Mobile Device Compatibility – Integrating with the mobile device operative systems is a key factor to succeed in today’s modern society, and QuickPay is definitely keeping up with all the trends. It allows existing Mobile Pay and Apple Pay users to perform mobile transactions without causing headaches for merchants preferring Android or iOS.

- Advanced Features – Should you choose a higher subscription plan, QuickPay makes sure you get your money’s worth. In this regard, there is the QuickPay Manager as a useful tool available to merchants in order to handle transaction records more easily.

QuickPay Online Casino Disadvantages

- Limited Coverage – Despite its wide availability and dedicated platform in nearly 20 different languages, there are still many eager users left out. Eligibility is considered as a kind of a drawback, and tech-prone team members of the company are working hard to remedy it.

- Limited Methods – The number of methods available for customers is well beyond 20, but still not enough to satiate everyone’s needs. As a result of some complaints regarding the methods available, the lack of others has been seen as a disadvantage.

FAQs

Does QuickPay offer its users a dedicated customer support contact option?

Yes, they can address customer support representatives at all times from any of the contact options available – live chat, email, or physical phone and address.

Name a few merchants that have already integrated the payment solution to their platform.

The company prides itself on the level of satisfaction achieved at their top merchant partners, holding testimonies of their leaders straight on the home page. These include companies such as Stylepit, Interflora, mofibo and SkatePro.

Will I be able to claim the deposit-related bonuses on respective QuickPay casino platforms considering its specific nature?

Yes, QuickPay still allows its users to enjoy all the benefits, bonuses and promos of the casino operatorts despite being an intermediary in the otherwise familiar payment process.

Are there any amount limits imposed by the company?

The QuickPay company focuses on overcoming the tech challenges, thus making users’ online payment experience all the more beneficial, not limited. They do not impose any minimum or maximum limits, so in case you encounter problems, we suggest checking with both the payment method and the casino’s terms instead.

What if my payment method is not supported through QuickPay?

In this case, you can try finding your preferred payment method as a separate banking option at your chosen online casino site. Of course, the service is always open for improvement, and would benefit from your suggestions regarding a popular method that could be added to the selection.