On this page

Klarna Casinos

On this page

Top Casino that offers Klarna:

Introduction

Each country, and its residents, has found their own way of handling the massive rise of technology advances, as well as the consequences thereof. While some worked on expanding and adapting their existing corporations, others used the opportunity to offer new business to start from scratch, only now using the many benefits of the modern time.

The Fintech companies in Sweden...

... are a definite example of the later tendency. These establishments are renowned for their drive towards innovative and unique approaches, and completely new business models. What is more, the regulatory policies in the country have the reputation of being among the strictest in the world, which further brings about to the company’s credibility.

These business endeavours have since found great use in a number of industries, especially the ones related to more modern inventions and technologies. In this regard, paying for services has drastically changed and evolved over the years, with the latest companies introducing complete new and revolutionary mechanics. With optimized security, processing capabilities, user convenience and service diversity, Klarna is quite literally leading the pack in this business sphere.

About the Company

As you may assume, Klarna...

... has been founded as a Fintech company in Stockholm, Sweden, back in 2005. At the time, it only catered to residents of their own country, but soon moved onto the nearest markets. During their initial progress, the company covered Norway, Finland and Denmark in their expansion.

From its beginnings...

...this Fintech company was focused on facilitating online payments by improving security, optimizing finance management and providing top processing times. Their services are based on the ‘pay later’ model, allowing users to enjoy prime transactions and payments, get the items they want while remaining secure and served in a timely manner.

By 2014, the company had already reached its peak in the aforementioned markets and took a major step in terms of expansion. They acquired SOFORT, an online banking service set up in Germany, and later extended to cover Austria, Belgium and Switzerland.

That way, the Klarna Group...

... came into existence, and has persevered throughout the years. Nowadays, their services are being used by over 60 million individuals across 14 countries, on more than 100,000 merchants that they have managed to partner with so far.

The progressive tendency attracted the interests of many global corporations. Thus, Klarna Group has come to be financed and supported by investors the likes of Visa, Permira, Atomico, Bestseller and Sequoia Capital.

Types of Services

There are several types of payment processing options available through the Klarna service. It has retained their primary model of online transactions, and additionally included new ones throughout the years. Coupled with the SOFORT instant online banking capabilities, the range of options created a rather convenient and accessible payment gateway used by online consumers in all available countries.

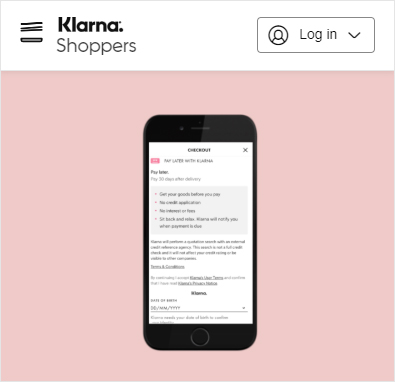

1. Klarna Pay Later

The founding idea of the Klarna service is to allow online customers to purchase items as soon as they see them. For example, you are looking at products from your favourite online clothes retail platform, and see a sweater that you like. However, your bank account is short on cash at the moment, even though you are expecting some money in the coming days. Klarna is here to help you get the item you want, and still pay for it without accumulating any debt.

The way that the ‘pay later’ option works...

... is that a person is supposed to register for a user profile before going through with the payment. Once you have your own credentials, click to purchase the item – be it sweater, a tech gadget or anything else sold at Klarna’s partnering online merchants, and enter them to log in. Just confirm the payment, and it will be instantly processed through their channel, to the respective retail platform.

Afterwards, users are given a timeframe of 14, or more commonly 30 days, in which they are supposed to pay for the item themselves.

Upon registration, all users enter a bank account that is linked with their Klarna profile. Before the expiration date on your timeframe – 14 or 30 days – users are supposed to have the funds available at the respective bank account. The service will also sent reminders, usually two days before expiration, in order to notify users of their obligation, as well as the future change in their bank account balances.

The principle of ‘pay later’ has helped a lot of consumers get a hold of the goods they need urgently, even if they don’t have the funds for an immediate payment.

2. Split It

The former option is much like a prolonger instalment payout, but the real loan-like structure is available through Klarna Split It. This option allows users to purchase high priced products, pay for expensive services and the likes through the Klarna payment channel, and then gradually pay off what they are due over a set instalment plan.

The service once again notifies users of an approaching deadline for an upcoming instalment, so that they can fund their account appropriately. What is more, users can normally choose the number of instalments, usually based on the overall cost of the product.

A subtype of this option is the ‘Slice It in 3’, offered to users who are willing to pay the price in three instalments. In such cases, they are charged the amount of the first one up front, at the cashier, and the other two are charged every 30 or 60 days.

3. Klarna Instant Banking

This type of payment processing by Klarna was added as a result of the merger with SOFORT instant banking.

The German service enabled precisely that – instant bank transactions for account holders from any of the banks in the country. Once Klarna took over, you can find the same service noted as SOFORT or SOFORT by Klarna. There is also a Pay Now by Klarna option. The first two terms note the intermediary service from a user’s bank account to the partnering merchant. Alternately, the later one enabled them to use their credit or debit cards to pay for their chosen goods or services.

The instant banking option...

...is their most recent one, yet it has managed to attract quite a massive user base. Numerous online payers wishing to protect their bank account information, as well as their credit and debit card details, have found a suitable replacement through this service. Due to this, it has become one of the most popular choices for customers and merchants alike, due to the many benefits it offers to both parties.

Using Klarna as an Online Casino Payment Method

Such a successful and extensive online payment processing service is bound to be useful for the ever-growing online gambling industry. Online casinos, as well as sportsbooks, poker rooms, and additional gambling platforms, incorporate the Instant Banking option by Klarna into their Cashier sections. Considering that these businesses depend on real-money transactions, it is only natural that the ‘pay later’ options did not suit the occasion as well as this one.

Making Deposits at Online Casino Sites

Step 1: Go to the casino of your choosing that accepts payments from this payment processor. Make sure it offers suitable player benefits, as well as the games from your favourite software providers. If it meets all your pre-requirements, head to the registration form and sign up for an account.

Step 2: Once you’re inside the casino lobby, looking to deposit some funds into your player account, head to the Cashier section. As mentioned earlier, the instant banking is the only option available out of the company’s range of payment plans, so look for Pay Now by Klarna, or alternatively, SOFORT by Klarna. Any of these two will allow you to perform instant transactions from your credit and debit cards or your bank account, respectively.

Step 3: Click on any of the options, choose your bank or card issuer, and enter the information needed for the transaction. There is no room for concern, as the service will remember your details for a later date, and at the same time protect them from outside influence. Before confirming the payment, enter the specific amount you would like to deposit, and you should see the funds transferred momentarily to your online casino e-wallet.

Withdrawing from Online Casino Sites

Step 1: Making online casino withdrawals using Klarna is more or less the same as depositing. Players may experience some difficulties in this regard, as the banking method is much less available for cashouts than it is for deposits. However, with the rising number of online casino operators and platforms, it shouldn’t be long before you find a casino that meets all your banking needs.

Step 2: Log in with your credentials, check to see that you’ve cleared any potential wagering requirements or limits on your winnings, and head to the Cashier’s withdrawal section. Here, you will most often find the SOFORT brand as an available option, but clicking on it will still redirect you to the Klarna platform. From here, the process is the same, only the transaction is done in the opposite direction – input the information of the account where you wish to withdraw the cash, and specify the amount.

Step 3: Before finalizing the withdrawal process, make sure you are going through the SOFORT/Klarna payment channel, and avoid using your bank account directly at the casino platform. Some operators don’t even allow direct bank wiring as a withdrawal method, making this service all the more appealing. Once you confirm the request, casino and banking establishments will take about 2 to 3 work days in total in order to process the withdrawal and transfer the money from your player account to your bank balance.

Advantages & Disadvantages

- Security – The number of users speaks volumes of the service’s reliability and trustworthiness, but this is all further boosted by their range of security measures. The company has made use of all precautionary encryption and protection certificates in order to provide users free and secure access to their funds. This way, they don’t share any of their personal information directly with the platform, but only with the processing service. Taking into account the fact that this Fintech company is approved by the Financial Security Authority in Sweden, there is little left to chance in terms of safety.

- Diversity – The range of services, i.e. payment plans is quite wide, offering users to pay based on their current financial situation. While this is not a standard loan bank, the Klarna banking establishment does attract a lot of users precisely due to the financial management options it provides.

- Customizability – Dealing with finances normally does not call for, or allow much freedom in order to preserve the user’s identity and funds. However, with this method, users still get the chance to modify the payment to their preferences. Thus, they can determine the number of instalments and the amount of each when using the ‘Split It’ option, or even ask for an extension given a logical explanation is presented.

- Ease of use – All in all, this level of diversity and massive application may make the banking service seem complicated. In fact, the Klarna platform and payment gateway are quite intuitive and easy to use, ensuring casino players and other online customers can get their funds without any hustle.

Despite the many bright sides, the service does have some inconsistencies which are their current challenges:

- Country restrictions – As mentioned, Klarna is currently available to residents from 14 countries. With most of them in Europe, and the USA to boost, the company is still a long way from providing payment facilitation globally, but they are certainly on the right track.

- Specific fee policies – Even in the countries where it is available, the payment processor features different fee policies. These normally depend on the country’s specific policies, or occasionally, on the bank linked to the account.

Klarna Casinos

Filter

More filters

If we have jumped the gun, you can remove that filter by clicking here.

FAQs

Is Klarna’s current market share significant, or are they experiencing a decline?

Klarna’s current market share covers approximately 10 whole percent of Northern Europe, and is further expanding to outside territories.

What kind of fee could I be charged when using the ‘Slice It’ option?

This option may see users charged with the Annual Percentage Rate (APR), which cannot be more than 18.9%. You will need to check with your retailer regarding the specifics, but be assured that it cannot be more than the specified amount.

What about the ‘Pay Later’ and ‘Instant Banking’ options?

The ‘Pay Later’ and ‘Instant Banking’ options normally don’t charge users any fees. However, your personal bank may impose a specific charge on the transactions, depending on various factors – the amount, the country of residence, the specific online merchant.

Will Klarna’s soft credit checks affect my credit scores?

No, Klarna’s soft credit checks are performed solely for the purpose of ensuring a user’s ability to use the ‘Pay Later’ service. Otherwise, even people that don’t have much or any income would be allowed to use the option, making it unsustainable practice for the banking service.

Is there any customer support I can contact in case of inquiries or issues with the service?

Yes, there is. Users are able to address the customer service straight from the 24/7 available live chat option. What is more, there are a number of dedicated pages on their official websites, specifically intended for business partners and private users alike. In case of less urgent inquiries, you can check out the FAQ page, or contact them via phone or mail.