On this page

EntroPay Casinos

On this page

Top rated casinos for players from Ohio:

entropay closed its doors on the 1st of July 2019, they made this statement:

Entropay not available

We're sorry to let you know that Entropay has ceased providing its services on 1 July 2019.

We have terminated our agreement with you according to clause 11 of the Entropay Terms and Conditions. You no longer have access to your account through Entropay.com. Withdrawals can only be made by contacting us by email on support@entropay.com before 1 July 2025.

Our terms and conditions will continue to apply during this period.

We are sorry to say goodbye to all of our loyal users and would like to say thank you for using Entropay.

EntroPay as an Online Casino Payment Method

The entertainment aspect of online casinos dominates the matter of game selection, platform software interactivity and overall casino friendliness, but the operator’s Cashier section is key to real money gameplay. In order to provide a fully optimized service, these online gambling establishments pay special attention when it comes to the selection of payment methods offered on the site.

The pillars…

...of any reputable and trustworthy payment processing service mainly focus on secure transactions, protection of user information and speed of processing operations. In an attempt to improve all three aspects of the trade, and consequently, the iGaming services as a whole, novel processors have taken to all kinds of approaches.

This resulted in banking methods that function as:

- online e-wallets

- payment processors

- prepaid cards

- virtual currencies

With EntroPay as one of the top instances of this new generation of payment facilitators.

About EntroPay

Properly described as an example of the new generation of payment processors, EntroPay is an e-wallet service that allows its users to store their finances to their online platform. It was established back in 2003, by a company called Ixaris Systems, situated in London, England, although the company now has offices in Malta as well.

As a result of this expansion of Ixaris Systems, EntroPay as consequently improved in terms of functionality and accessibility, ultimately reaching a global coverage of more than 120 countries to date.

In its basis...

...the e-wallet EntroPay functions like any other platform of its kind – people are able to register for an account with the service and use a range of eligible payment options to fund it. These normally include standard, existing banking methods the likes of credit and debit cards or even direct bank transfers.

Either way, once you fund your e-wallet account, you are able to use it across any retail and other e-commerce online service to make payments, transfer funds or even withdraw them onto their personal e-wallet.

EntroPay Virtual Card

What distinguishes EntroPay from the bulk of e-wallet services is the fact that it makes use of the Visa payment processing network for its purposes. This adds weight to the company’s popularity, reliability and thus success due to greater user interest.

Moreover, the specific Anglo-Maltese Bank of Valleta is the financial institution behind its transaction processes, as it issues the virtual card players obtain as an EntroPay e-wallet account. Such circumstances and structure explain the similarities between standard debit and credit card online payments and the respective service’s process.

To illustrate:

EntroPay payments at any online retail platform are performed by selecting this option out of the banking methods on offer there. This will lead users to a separate window which requires their specific username for the e-wallet service, the account number and the CVC/CVV 3-digit security code – all provided as details of your EntroPay Virtual Visa card.

Hence, it can be concluded that this EntroPay Virtual Visa operates as a prepaid debit card, containing the funds that you actually own. While it may seem insignificant at first, such cards indirectly prevent their users from going into debt, as they can only be used until there’s actual money on it.

A way around it...

...fund the Virtual Visa with a regular credit card, but keeping in mind your best financial interests, it is a less advisable way to go.

EntroPay MasterCard

The number of online retail platforms and other e-commerce establishments is constantly on the rise, allowing people to order, pay and experience any product or service completely digitally.

Still, the need for actual cash or offline land-based card payments is much present, which is why EntroPay have partnered in with MasterCard for this occasion, and nowadays provide their users with an actual Plastic Prepaid EntroPay card.

The Plastic Card

It bears the same details as your Virtual Visa, further benefiting its users with its top-notch security protocols and transaction speed. It can be used to withdraw cash from ATMs, or to pay with it at any land-based shop that accepts MasterCard, which offers quite a bit of opportunities on its own.

Casino Payment Method

Considering that it functions much like any regular credit or debit card for its online payment requests, yet adds an extra layer of protection between the e-commerce platform and the banking details, EntroPay is irrevocably fit to facilitate online casino payments.

One major concern

Players safety and reliability of their personal information, banking details included. While gambling operators normally employ the latest security measures, having one extra layer of protection never hurt anyone. EntroPay enables this due to its role as mediator between players’ personal bank accounts, credit or debit cards, and the casino and similar gambling sites.

EntroPay Deposits & Withdrawals at Online Casino Sites

To best understand the purposeful specifics of EntroPay, it is enough to follow the simple depositing and withdrawing procedure at your chosen EntroPay casino. Most casinos normally include this novel payment option without much thought, as it is in fact affiliated with the long-standing Visa card processing service.

Regardless, as explained above, the process of paying, or in this case, transferring financial means from one account (EntroPay) to another (the online casino player account) is much like commonly found credit card payments.

Step 1: Access and sign in at your chosen online casino platform with the relevant player profile credentials. Despite the reliability of the processing service, make sure for licenses, certificates, software audit records and regular testing information at the chosen site prior to engaging in gameplay. After that, you can access the Banking/Cashier section and select EntroPay as a payment method.

Step 2: Click on the EntroPay icon to reach a new window which would require you to input your respective e-wallet details. That way, the service’s Virtual Visa card will simply transfer the funds into your casino player account. For this purpose, you will need to enter the abovementioned information – username, card number, CVC/CVV code and the amount you wish to deposit to your casino account.

Step 3: The EntroPay online casino deposits are free of charge and instant, so all you have to do next is choose from the game offering and enjoy.

Withdrawals made from your account to EntroPay Virtual Visa differ from deposits solely in the direction the funds need to be processed. Other than that, players have to enter the same sections and input the same information in order to get as much from their casino winnings as they want to their EntroPay card.

Once there, these funds can be used for online payments, ATM cash withdrawals, or further transferred to your regular debit and credit cards to cover potential debts.

EntroPay Online Casino Security & Support

It has become an industry standard, and a mandatory provision imposed by all authoritative bodies that their licensed operators would employ high-end security certificates. Thus, online casino platforms nowadays protect their players from any third party interference attempting to temper with either their personal information or their finances.

EntroPay Virtual Visa is licensed with the popularly stringent Financial Services Authority in the UK, and operates under their authorization. This, along with on-site security is enough to reassure players of their safety, but EntroPay takes extra precautions.

Hence, the e-wallet service issues temporary virtual cards that expire after a given time; plus, their transactions, as well as those of the Plastic MasterCard are protected by high-end 128-bit encryption. Transactions practically topple the security of credit and debit cards, gaining a +1 advantage, all to better serve EntroPay casino players and users alike.

Customer Support

When it comes to customer service and support, this e-wallet distinguishes itself prominently from the rest. As it is, EntroPay features its own support center equipped with trained and knowledgeable representatives available both during the work week and on weekends.

They can be contacted either via the specific contact form on the site, or via the service’s social media profiles – Facebook, Twitter or LinkedIn. Alternately, more independent users, or those tackling smaller issues or inquiries can equally address the FAQ base, also available on the site.

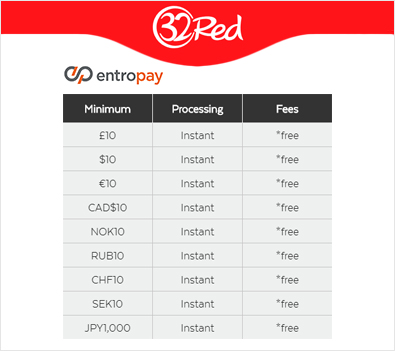

EntroPay Online Casino Transaction Fees

Generally speaking, online casino players are interested in finding a payment method that will offer a balance between security, efficiency and fee charge acceptable to their tastes. In this regard, it is important to point out that EntroPay Virtual Visa, as such, does not charge a fee for deposits and withdrawals to and from your account.

Nevertheless, players will face some charges prior to these activities, as well as following the deposit and withdrawals processes. In regard to funding your EntroPay Virtual Visa done by credit and debit cards or bank transfer, as mentioned earlier, the former method would see users pay a 4.95% fee. Incoming funding transactions from any third party establishment (bank transfer) can reach up to 1.95% fee, while those funding one EnropPay Virtual Visa card with another one, usually due to expiration, will see their transactions charged with a low fee of £0.10.

Fees are further charged for currency exchange processes performed through the service. While EntroPay may well have your preferred currency among its selection of 14 so far, the online casino platforms are known to be less flexible. Therefore, checking for the eligible currencies is another notable consideration when optimizing your EntroPay gameplay.

Bonuses & Game Selection

EntroPay casinos are player-oriented, as the payment processing service itself is definitely beneficial to all parties involved. Consequently, the player bonuses, as well as the selection of game titles available on the EntroPay online casino platform are bound to follow in the same fashion.

Bonuses can be distinguished by the amount awarded to eligible players, but in respect to the wagering requirements and general bonus terms and conditions. A bonus is only good if players end up winning rather than losing money when redeeming the respective offer.

In reference to this, players should be aware that some operators specify their bonuses with regard to the payment method used, or the game titles it can be redeemed on. This is done to promote either of the two, or at the same time to reward players for making the respective choices. All in all, EntroPay casinos generally boast a rather varied, generous and rewarding bonus and game selection.

FAQs

Will I need to share my home address to perform EntroPay transactions?

Yes, EntroPay requires that their users enter their home address upon registration as a verification process, but will not share it with any online retail platforms.

Does EntroPay have any kind of Reward program, like most other debit or credit cards?

Yes, EntroPay users are able to benefit from the EntroPay Cashback Rewards Program. It is triggered each time you top up your EntroPay account with one of the service’s partners and spend €10,000 on one of the partner’s websites within the 90-day window.

Will I be charged for a dormant account if I cease using my EntroPay Virtual Visa card for a longer period of time?

For inactivity lasting a minimum of 6 months or above, EntroPay cardholders will be charged a monthly dormant fee of $2.5, which is still relatively low in comparison to other services of the same nature.

Can I withdraw money from the EntroPay Virtual Visa to my new credit card?

Unless you have used the same credit card for the process of funding your EntroPay account prior to requesting a withdrawal, your transaction will not be authorized. This is so due to the fact that EntroPay takes great care in security, and does not allow withdrawals to credit, debit cards or bank accounts that haven’t been verified.

Does EntroPay have any limits imposed on the funds transfers they perform?

Yes, EntroPay does impose a specific maximum limit when it comes to the amount they can transfer - $6,000/£4,000/€5,000 per transfer.

Author: Shelly Schiff