Reporting Digital Assets

To follow up on last week’s newsletter, I followed my own advice and got four rooms at the Super 8 in Waco for April 7-9. I plan to offer them to friends and family. I may need one myself if the owner of my Air B&B for the eclipse re-negs on the deal, which everyone tells me they are allowed to do and probably will.

It seems to be that Waco is booked up solid. However, don’t lose hope. Some hotels release rooms less than a year in advance. I think many will release their April 2024 rooms on April 30 of this year. So, keep trying. The eclipse will also pass through much of Mexico, all the way up to Maine, and then parts of Canada.

I also wrote about the Burning Man ticket sale last week. Unfortunately, for the third attempt in a row, I was unsuccessful. I looked at the following image on three computer screens for 80 minutes before it suddenly said the sale was over.

A knew several people attempting to get tickets and one of them was successful. Meanwhile, I will go into kiss-ass mode around my fellow Vegas burners, hoping to buy a ticket as the event gets close from somebody who gets cold feet.

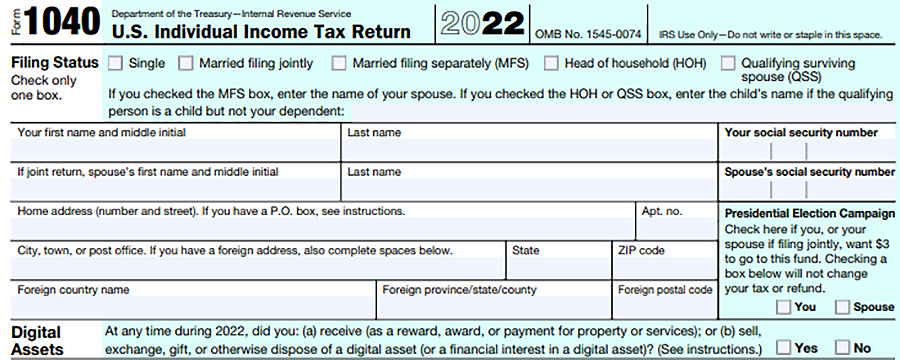

For the American procrastinators on my list, let me address your obligations regarding “digital assets.” At the top of the 1040 form, right under the part for your address, it asks if you had any digital assets at any point in 2022.

If you check yes, you will be required to declare any income from sales of such digital assets. This is done on form 8949. The least you will need to indicate is the date and value when acquired as well as sold. If you have had many transactions, remember it is “first in – first out” in determining when an asset was acquired. For people that had hundreds of transactions, I’m sure this form is no fun.

To make matters worse, if you ever had more than $10,000 at any one time in 2022, in the same account/wallet, you must declare the account via the FBAR form (Report of Foreign Bank and Financial Accounts).

I’m sure it is tempting to “just say no” to the initial question. I’m pretty sure that wallets licensed in the U.S., like Coinbase, must disclose their anybody who made a profit to the IRS. For wallets outside the U.S., my financial advisor tells me the government is requesting those records and has leverage to get them.

Personally, I am not going to preach to anybody what to do. I hope I have explained the pros and cons both ways correctly.

Until next week, may the odds be ever in your favor.