On this page

Bet as an Entity!

Cut Out the Middleman (Yourself)

Many people might consider betting on Sports to be something of a hassle. First of all, you either have to pour all over the Lines looking for positive value, do deep analytical and statistical research on team and players, comparison shop Lines across all of the Nevada Sportsbooks. Furthermore, if you're out of State, then you have to find someone willing to get down the money for you. Nevada's new, 'Entity Betting,' is going to cut through all of that by taking the decision-making, and the money, directly out of your hands! However, is that necessarily a bad thing?

Senate Bill No. 443 in Nevada passed in 2015 giving, 'Investors,' from outside of the State of Nevada the opportunity to blindly place their faith and cash in the hand of Sports Betting, 'Entities,' which are treated as an investment. Here is a link to the Bill:

https://www.leg.state.nv.us/Session/78th2015/Bills/SB/SB443_EN.pdf

These, 'Entities,' are essentially businesses that operate as an Investment firm thereby allowing participants, 'Investors,' from other States to invest money which is then to be wagered on sports (and possibly racing) events in Nevada Sportsbooks. In this case, no laws are violated (Nevada cannot accept wagers from individuals in other States unless said individual is physically present in the casino...which is why they will not discuss Lines on the phone) because the Investors are not permitted to have any input as to what the Sports Entity bets on.

In other words, the Investor now gets to go up against not one but two vigs. The first vig is obviously that of the Sportsbook who, based on their Lines, is expected to make a percentage of the total money wagered. The second vig, of course, shall come in the form of any Commissions or fees that will be due the Entity which may or may not (depending on the agreement with the Investor) be contingent upon winning. This could be problematic for some, in my view, because even if one were to believe that the Entity had a high probability of making Net Profitable bets, the Investor will only see a portion of the winnings from those bets as, obviously, the Entity has to make something. Although, it should also be considered that, with a high enough probability of profit over the course of your investment, you are very unlikely to lose.

One site that provides information on some of the available entities is WagerTraders.com, which can be found below:

I also did an interview with Todd owner of WagerTraders.com, which will appear later in this Article:

Many of these entities operate under different agreements with the individual Investors, with one such Entity being the Nevada Sports Investment Group (NSIG). This is actually one of the better known funds and has been featured in quite a few National publications and broadcasts. While this fund requires a minimum investment of $25,000, which will be too steep for many people, it is one of the funds that allow an Investor to withdraw from his account at any time, whereas, many of them hold your funds for a certain period of time.

NSIG also stipulates that the Investor's cut is 70% with a 30%, 'Management Fee,' going to the Entity. Furthermore, the Entity states that it uses a Statistical and data-driven approach with respect to making its bets.

That 30% cut is very important, however, because one needs to consider that the entity could theoretically lose, particularly in the short-term, even if they are making good bets. Interestingly enough, the more that they make in terms of winnings, the greater the dollar amount that you will actually be paying them. The only way to determine whether investing with this Entity is advantageous, of course, is to do your best to determine the amount that you are most likely to win, the probability of doing so, and then offsetting that against your probability of losing. In other words, even if the Entity had a high probability of making some money that is going to need to be offset by the probability that the entity loses all or part of your investment.

Ken Murphy of NSIG Interview

Fortunately, Ken Murphy of NSIG was very kind in taking the time to conduct an exclusive phone interview with me, which appears immediately below:

WizardofOdds.com: Can you explain to me how the Nevada Sports Investment Group's Commission system works?

Ken Murphy: We refer to it as a, 'Performance Fee,' which is paid quarterly with an, 'Arrears,' and is based on the high watermark, which is a common investment term.

Because I cannot quote the way it was explained verbatim (I did take notes) I am going to describe how the structure works at this time. For our first example, we are going to take a look at Three Quarters in which $5,000 was won in the first quarter (for a specific investor) $2,000 was lost in the second quarter, and $8,000 was won in the third quarter:

| Quarter | Result | Performance Fee |

|---|---|---|

| First Quarter | $5,000 | $1,500 |

| Second Quarter | ($2,000) | $0 |

| Third Quarter | $8,000 | $1,800 |

One might ask, 'Isn't 30% of $8,000 $2,400?'

That's not exactly the way that it works with NSIG, any profits in the Third Quarter would be offset by the losses in the Second Quarter, as a result, the, 'Performance Fee,' would only be paid on the Net Profit for those two Quarters, which is $6,000, and therefore, a fee of $1,800.

Furthermore, after the Fourth Quarter, there exists what Ken Murphy refers to as a, 'True up,' and the way that works is that, in the event monies were lost during the Fourth Quarter, another $2,000 for example, then $600 of what was paid on the Third Quarter profits would be considered an overpayment, of sorts, and therefore, $600 would be returned to the account of that particular investor.

WoO: Yours is one of the investment entities in which monies can be withdrawn at anytime, despite the fact that you require a minimum investment of $25,000. Does that mean someone could theoretically withdraw profits as they are made?

KM: Our website states that withdrawal requests will be processed within three days when practicable. Generally speaking, withdrawal requests are processed on the, 'Same day,' however, we do have a minimum withdrawal of $10,000.

WoO: With respect to that $10,000 withdrawal, could somebody theoretically circumvent your $25,000 minimum deposit by depositing said amount and then withdrawing an amount that would bring their balance to under $25,000, or are they required to have a minimum balance of at least $25,000 at all times?

KM: The reason that we have a withdrawal of $10,000 and that we don't, 'Lock up,' the money as some other investors might is because we recognize that there are short-term needs and we want the money to be as liquid as possible. Secondly, the majority of our investors are sophisticated investors and the entity investment would be a small part of their portfolio. Many of these investors have total investments in the range of six to seven figures overall, so $25,000 isn't really that much for them.

With that said, we do have the minimum deposit of $25,000 in place for a reason. We normally wouldn't have a problem with people withdrawing money and having a balance of less than $25,000, but if it became pervasive or if people were constantly putting money in and taking it right back out, we could decide whether or not we wanted to continue to do business with them.

WoO: For some people, $25,000 might be a substantial sum of money. Could anyone unable to come up with that sum possibly invest with your entity?

KM: They could, absolutely, the total sum invested would just have to be $25,000, or more. If you had a group of five friends, for instance, who wanted to invest $5,000 each, then they could form an LLC or Corporation for that purpose and invest with us as one business investing with another business. Their entity would just operate as a business and would distribute any monies (if withdrawn) according to whatever agreement they have.

One thing to keep in mind about that is that all investors have to be approved, and that applies to each individual who was part of that established business entity. Therefore, you would have five people who would need to be individually approved.

WoO: When you make the Investments on a particular game, is there any input to the extent that they might apply to some accounts and not others, or does every individual bet apply to every investor in the pool of investors?

KM: We NEVER make investments that would apply to some accounts and not others. 100% of wins and 100% of losses are shared proportionally based on the total pool and the percentage of that pool that each investor has as of that given day. If you are an investor and the total you have invested with us represents 5% of the pool, then you take 5% of the win or loss.

WoO: How aggressive are you with the investments? If you saw a good opportunity, what is the most you would put on it as a percentage?

KM: Every bet is roughly 1% of the total fund. We are conservative in nature, yesterday we happened to make a 2% investment this is all available on our website:

http://www.sportsentitywagering.com/selection-archives/

I might invest up to 3% of the total pool on a certain side, but I really don't foresee any situation where I would be likely to invest more than that. We are really in this for the long-term, and it is possible to have losing events and even losing quarters. If we win on 60% of our sides, and that is my long-term record, that means we lose on four out of ten events.

WoO: Is it true that investors do not have any input on the sides of an event that are invested on, and that, in fact, out-of-state investors legally cannot?

KM: That is true, although, we are permitted to tell the Investors what we are doing before the start of the game, although, some entities do not choose to do that. Some investors actually would prefer not to even know and would just like a monthly report, but some investors do like to know ahead of time.

As far as input goes, I make 100% of these investments. I even have an excellent handicapper on my Advisory Committee, and we agree or disagree on some investments privately, but everything that we do is 100% my decision. For example, I went out of town in May to visit my grandchildren, and when that happens, we go completely dark. We don't do anything during those times.

WoO: What is the process that goes into making your picks? Is it strictly analytical?

KM: It is definitely statistics and analysis that go into making a pick. Everyone obviously has emotions, but I try to take emotion out of it as much as possible, I recently made a 2% pick against my favorite team. There are subjective factors and other factors that statistics may not account for, though. Typically, if I am conflicted in my subjective lens and my analytical lens, I leave the game alone.

There are also a number of other plays that are just statistically solid. Yesterday, you had Santana against Verlander (Minnesota Twins @ Detroit Tigers 7/20/2016) and we had a Line for under five runs in the first five innings. Those are two very solid pitchers, and I figured if they got through the first inning, and each side actually had a solo home run in the first inning, that it is going to be a very high percentage play. The next seven innings were scoreless.

We were also on a Line of Under 9 runs for the game. You figure that the bullpen is probably going to deliver if the starter goes deep in the game, but might not deliver if he doesn't. This was definitely a good bet after it looked like the starters were playing well.

WoO: What are the reporting mechanisms that are in place? Are there any tax considerations?

KM: We have a commitment to certified annual accounting which includes an audit of our performance and financials. Included in this is the fact that our investors will receive an annual report in February, whether or not they withdraw their money, any profits would be taxed as gains.

WoO: For now, the exclusive Sportsbook at which you can get bets down is CG Technologies? Do you have any concern that they may, 'Back off,' your entire entity, is that something they can even do?

KM: We're still small potatoes compared to the mainstream investment community. Because we are only investing 1% to 2% on any game, the amount we are making is relatively small. There are, perhaps, individual bettors who may put more on one side or another than we do as an entity. I could see this being problematic if we grew to being a forty or fifty million dollar fund and a 1% bet would be $400,000, then there might be a question of whether or not they would be willing to book that kind of action.

That's one reason that I am not afraid of competition, in fact, I don't even look at them as my competition. I hope that there are 100 or more entities within the next few years because then the action might be more spread out and more books might get on board with this.

Other than entities, there is one of everything right now. There is one Sportsbook and only one bank that has agreed to do everything according to the way the State wants it done and we also have to verify not just that an investor has adequate funds, but also the investor's source of funds. The Bank of Nevada is the only bank that works with this right now.

I do hope that this all becomes mainstream because it means that there will be more entities and more Sportsbooks. I imagine some of the entities will have profitable quarters and years and others will not.

WoO: Right! If you had the right side of a Line, I bet you would love nothing more than for an Entity to have invested on the other side!

KM: It's not just entities, but yeah, the Sportsbooks have to make money, too, or none of this works. Either way, even if an entity took the opposite side of my entity it's hard to say whether one side is right or wrong. You can have statistical analysis and computer programs, but, at the end of the day, taking one side or another is just one person's opinion vs. another.

Of course, that's one reason that I certainly hope that more entities pop up and more Sports Books are open to having betting accounts with the entities. If I am looking at a Point Spread that I like at -2.5, or less, and CG only has it at -3, then my choices are either to make a bet I think is a bad one or not play...I'm obviously not going to make a bet I think is a bad one. A different book might have that game at -2.5, or even perhaps at -2, and I am probably going to play that Line personally, but I obviously cannot play it on the entity's behalf.

WoO: I don't know if one would say an, 'Under,' in five innings technically qualifies as a Prop Bet, but on Prop Bets, WizardofOdds.com has reported on many positive Expected Value Prop Bets on the Super Bowl. Would you say the entity will play those or other Prop Bets?

KM: There are a couple of reasons that we probably wouldn't, even though I might play one that I think is strong personally: The first reason is bet Limits are too low on Prop Bets to really be of any interest from the standpoint of the equity, the second reason is that I also consider them a bit too speculative to have the entity bet on them, so I doubt we will invest on that.

WoO: What do you think makes Sports Entities an intelligent way of investing money, in general?

KM: Right now, we are in the process of writing history: Our own history. We have had a positive three-and-a-half months so far, but I will be the first to acknowledge that three-and-a-half months doesn't mean anything. Some people are going to sit on the sidelines and watch this history be written and some will be frontrunners. I had a Blackberry phone much longer than most people did and, about a week after I got the IPhone, I said to myself, 'What the Hell was I still doing with that Blackberry all that time?'

The history that we want to write is one of success over a longer period of time which will get more people off of the sideline and investing, not just with us, but maybe with the entities on the whole. Anything can happen in three-and-a-half months, and we have had positive results. I definitely want to have a history of years of sustained success that will make us an attractive option to virtually any investor, but there are no guarantees.

WoO: I always tell people, when it comes to Sports Betting, whether it be an investment firm like yours, a tout, or anything else...if you hear the word, 'Guarantee,' run in the other direction!

KM: That's absolutely right, and that's not a word I would ever use because it is not true. Our results over the last three-and-a-half months are positive, but we did have a losing month in there. You're not going to win every game, like I said, if I win 60%, then that means that I lose four out of ten picks. You can sustain losses over a week, over a month, over a year or over a lifetime. What I want to do is generate a history that shows that we are expected to produce profits for our investors, but I would never guarantee anything.

WoO: Do you have any advice when it comes to individual investors and why they should choose your firm over others?

KM: My advice to investors is to make the decision they think is best for them. The most important thing if they want to get into this is to do their homework and look into as many different entities as they are inclined to. Different entities also cater to different demographics, where the bulk of my investors have six to seven figures in varying investments in total, there are some entities out there that cater to people with less money that they could invest.

Again, I wish there were 100 funds out there because that would give us access to more books, I would think, and also, every investor could find an entity that is the best fit for them. I do think that the numbers will bear out that entity wagering should be a part of anyone's portfolio.

Even when you compare it to the Stock Market, there are so many factors out there that can impact a company's stock valuation that have nothing to do with the company directly. You have which politician gets in office, Brexit, the Federal Interest Rate, Oil Prices, a Hedge Fund short selling a stock, and stocks, taken individually, are often a very long-term play.

There are thousands of stocks out there and I feel like Sports offers more Limited Investment Options with much faster resolutions. If you have thirty teams, then there is a maximum of fifteen games that can be played on a full day. If we pick just one of those games, then the investors know how that investment went when they wake up the next morning and it is on to the next. The longest term investment we might look at is we might like a Line on an NFL game on a Monday and that game doesn't get played until Sunday.

This is also a highly liquid form of investment. The majority of an investor's money is available at any given time, so you do not have it all tied up on varying investments. Also, since the money can be withdrawn at any time, this also represents very easily accessible cash for whenever it is needed whereas it might not be advantageous, or even easy, to get money out of a different form of investment.

WoO: Thank you for taking the time to do this interview! It has been a pleasure speaking with you today, but before we go, certainly you can give me a few reasons why someone might look to your entity specifically…

KM: We are professionally managed and communicate with our clients well. We may have the highest fees, but over time, I believe that we will create the highest net profits for our investors, and also, an investor can get money out absolutely anytime with no penalty whatsoever.

WoO: Thank you again, Mr. Murphy.

____

That was our interview with Ken Murphy of Nevada Sports Investment Group which offered, in my opinion, a ton of valuable insight on the concept of Equity wagering as a whole, his company specifically, and (some would argue) compelling arguments as to why Entity Wagering might be a reasonable position to take for some amount of an individual's overall investment profile.

Interestingly, a $25,000 investment made on March 31st, 2016 is now worth $31,531.26 as of July 22nd, 2016, which represents an annualized growth rate of 89.57%. While nothing could be used as a long-term indicator of future success, NSIG is arguably off to a very impressive start, as Mr. Murphy indicated in the interview!

I would also like to say that Mr. Murphy is a consummate gentleman as well as being an extremely polished speaker. If you would like to hear him on The Las Vegas Sportsline, simply click this link and jump to 31:10 in:

Of course, this is not meant to be an advertisement for NSIG, especially not for those readers who would not have the requisite money to invest (minimum: $25,000) and for whom it would not be a simple matter to start some sort of partnership, so let's take a minute to discuss the other entities that are available:

Bettor Investments is based out of Reno, Nevada and was also one of the first entities to jump into the game. This fund differs substantially from NSIG in that there is only a minimum deposit requirement of $500 to get on board. Any fund growth is also either paid monthly or reinvested, and they maintain that they do not bet any more than 2% of the funds value on one outcome.

The management fee with Bettor Investments is also lower in that they only take fees of 15%, however, those fees are based on every positive month given that there are positive returns.

However, Bettor Investors seems to be slightly less transparent with their results than NSIG, as you can see from their website:

They publish their overall monthly results, however, the results of any individual games are only available to active investors. While they do have a page detailing a Sample RoI:

http://bettorinvestments.com/sample-roi/

That really doesn't speak to their actual results or the meaningfulness of the Win/Loss Ratio that they show on the website to non-investors. By no means am I suggesting that they are not a profitable entity, I am merely suggesting that I like how NSIG make their individual Picks (after the fact) available to everyone. For instance, if you are Picking teams straight up that have a high implied probability of winning based on the spread, then you should have an extremely high win rate...one that could theoretically be losing money!

Another entity is Contrarian Investments, who started active investing a few weeks after the two previous entities. This entity requires a lower minimum deposit ($1,500) than NSIG and slightly greater than that of Bettor Investments, however, there are only two days of the year upon which an Investor may withdraw funds. For investors who are concerned with being able to readily liquidate their investments, obviously, Contrarian Investments is not an optimal choice.

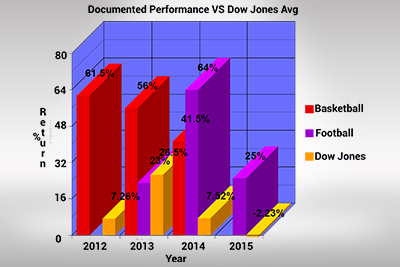

Furthermore, they are extremely conservative and state that they make very few plays per month, which may be why they hold funds for such a long time. They also hold 20% of high watermark profits along with a first-time deposit fee of $50. Interestingly, this site does compare their results to the DOW Jones Industrial Index showing how they outperform the DOW significantly in the last few years:

http://contrarianinvestments.net/historical-performance/

If you like being, 'In the action,' though, that might be another reason to avoid Contrarian as they have made a total of six bets between Mid-April and Mid-June. However, Chris Connelly does have an established public history of winning, so this might make for a strong group for those who wish to invest very conservatively.

Chris Connelly Interview

Furthermore, I found out in an exclusive interview with Mr. Connelly that they focus more on Football and Basketball (both College and Professional) and that he doesn't play against MLB Lines, so that is another reason they have very few picks this year. However, Mr. Connelly does have a publicly recorded history of successfully betting sports over the last several years. Here is my interview with him:

WoO: I've covered some of the fundamentals of this in an earlier interview I conducted with Ken Murphy, so I hope you won't mind if I get directly into specifics. It's just to avoid redundancy. One major difference between your agencies is that you only offer investors the ability to withdraw twice a year, is there any reason for that?

CC: There are actually a few reasons, and it is typical of both investors and Sports Bettors to bet more after wins or less after losses, so I don't want people pulling money out based on the results of individual games. My betting structure is based on the Kelly Criterion, and it is also based on the initial amount I have available to invest, so to have money pulled out suddenly based on one or two results can impact that negatively. I also advise my investors to wait until the end of the holding period to invest MORE because I don't want them making decisions based on short-term Variance and a couple of wins in quick succession. I also don't want to spend too much time constantly processing the transactions and associated paperwork. I want to be finding good picks. I don't need people looking at a pick I made on a huge underdog, say the Jaguars or 76ers that loses (though I had a positive expectation) and saying, 'How could he pick that? I need to get my money out!' Every season is a process.

WoO: You mentioned that the returns, in terms of dollars and cents might not necessarily be dynamic, but in terms of percentages, they are through the roof so far!

CC: Definitely, and I am seeing more and more investors brought into the fold. Investors of anything are thrilled to see a 105% return on investment over a period of a few months, let alone 19.5%, which is where I am right now this year. Personally, I couldn't return in the area of 5-10%, I wouldn't personally make enough money and have to get a, 'Real job.' If I only return a positive 5% in a given sports season, then that is a disappointing season for me...but there are no guarantees.

WoO: Why do you allow for lower minimum deposits than an entity such as NSIG?

CC: This is kind of new to the investors, so they want to test out the results. They could sit on the sidelines and do that as I report all of my results on our site, but some of them want to have a limited stake. I do have a few investors that would satisfy the minimum at NSIG, but they have been following me for years and already know what kind of results to expect. One investor had been following me and subscribes to my E-Mail picks, and I sent an E-Mail to all of my followers about this opportunity and he invested initially and then increased his investment after a few months.

WoO: It seems you make fewer picks than NSIG, why is that?

CC: I will definitely trend lighter on volume of picks than NSIG, but I only Pick Football and Basketball and they do MLB, so that's part of it. By the time all of this got started, College Basketball was done for the year, football has not yet started, so I only had a handful of NBA Playoff games which could even potentially be picked. My Philosophy is also to be very conservative in choosing plays, so I only want the very best value plays, there haven't been many of those since equity betting was approved.

WoO: Your website says that you will risk as much as 5% of the fund on an individual result, which is a greater percentage than some of the others out there, why is that?

CC: The goal for every play is to see where the limits are compared to the fund and hopefully not be limited to 2-3% per play. Based on the Kelly Criterion, the appropriate risk is 5.3%, on average, based on historical results on the sides that I am looking for. There simply are not so many great plays throughout the year that I would want my maximum percentage investment to be less than that.

WoO: With that greater percentage of the fund you are willing to risk, though, does the prospect of a losing season due to nothing more than Variance concern you with respect to how potential investors will perceive you?

CC: With College Basketball, this last year was my worst season ever, but it was actually counterbalanced by my best NBA season ever, so it was funny how that worked. The point is, that I was profitable for the overall basketball season and I have yet to have a Net losing season in any given sport, so I am confident in my long-term results. My history of picks is well-documented, so hopefully investors can take a look at that and they will be confident, too.

WoO: What is the difference between the Sports you play and Baseball?

CC: With so many games, I think the edges in baseball are a little tighter than I would like, and I also think that may be why some entities and bettors that bet baseball do not risk as much of their bankroll. Of course, things will work themselves out in the long run and we will see where their results will be.

WoO: Do you agree with Ken Murphy that you do not see other investment entities as competition?

CC: Absolutely, if Sports Betting becomes legalized throughout most of the states, then the handles will become greater and people will be willing to invest more. Our limits will also go up which means that we can get more money down for our investors. I welcome new entities and I want square bettors to pick bad lines. Hopefully, other entities disagree with my position on certain sides and bet on the other side of the side I am taking.

WoO: Do you have any concerns that CG Technologies will reduce your limits or back you off completely as an entity if you consistently beat them?

CC: That was my main concern when starting the entities and I was notified at the same time to start wagering, that's why I did not make any wagers the first few weeks even though I was able to at the same time as NSIG. I spent two weeks ironing out these sorts of issues and am essentially taking CG at their word that they do not mind taking our larger action and will absolutely not ever reduce limits, only increase them as far as entities are concerned. I would obviously like the limits to be higher, but what is in place now will work for the time being, I am doing this because they said they would honor the limits that they set for entities.

WoO: What do you think CG Technologies motivation is for doing this?

CC: I believe that legalized sports betting will be more widespread within a few years and the books that engage in entity betting will be allowed to operate in all of these states in which sports betting is legalized pursuant to S.B. 443. In addition to that, I think it is also possible that they will use what we (the entities) do in order to expose weak lines, which could actually save them money.

WoO: At what point do the other entities become competition?

CC: I think that the cream will rise to the top and Contrarian Investments will be one of the best if not the very best. We are also very transparent with investors and non-investors alike in terms of showing our specific results. I don't trust many people, the results they claim to have, or the way they promote nothing but win/loss records. How much money have you won with that win/loss record? Are you making straight bets against a huge underdog to get that huge winning percentage but still losing money overall, who knows?

WoO: Is it not also true that an investor might go to NSIG for MLB Investments, since you don't do those, and could conceivably come back to you for Football or Basketball investments?

CC: Absolutely, if that's what they want to do. I have extraordinary confidence in my long-term results which is why I am not afraid to make transparent everything that I do. Other entities may do the same thing, so an investor might invest with one entity during one season and another entity at another time, or even with multiple entities simultaneously.

WoO: Right, and isn't the angle really diversification of investment?

CC: Absolutely! In that sense I am not competing just against the lines or being compared to other entities, but really, I have to outperform anything else anybody could be doing with their money to be successful.

WoO: Why should people invest with Contrarian Investments specifically?

CC: I didn't come here after this started. I have a documented success on multiple platforms and over several years of being a long-term winner. Not only that, but any picks that I pick for the entity I also back with my own money, (Author's Note: The implication is, if the investors lose, he loses, in more ways than one since he loses potential, 'Performance Fees,' as well as his own personal money) so I am not just gambling with other people's money. My history of success has spoken for itself so far, and I am confident it will continue to do so.

WoO: Thank you for your time, Chris.

Again, speaking to Chris Connelly also made for a most enjoyable interview, and it was interesting to get his take on things. I am not going to reveal any personal opinion as to whether or not I would address with them, but the aspects of that organization that I perceived as shortcomings in the section immediately prior to the interview, I believe, were more than adequately addressed during the interview.

Hi-Line is a fund that is specialized just for MLB betting, so an investor also wanting to get in on action in other sports might need to operate through multiple entities. Hi-Line does not have a lock out period on investments and requires an investment of only $1,000. Furthermore, as with Contrarian, they do take Performance Fees of 20% either upon withdrawal or at the end of the MLB season. According to Hi-Line, they are somewhat aggressive compared to other entities as they are willing to invest up to 5% of the entire fund on one game and have as much as 20% of the fund exposed at once.

Hi-Line is operated by Beau Noeske, and as of the time of this writing, has perhaps less information available on their website than any other:

http://hi-linesportsinvestment.com/

The above four entities were brought to you by WagerTrader.com, and I had the opportunity to speak to the owner of WagerTrader.com, Todd (he preferred not to give a last name) and got some of his opinions on this new industry as a whole:

WoO: You're kind of on the ground floor with directing people to the different entities, are you optimistic about the future of Entity Wagering?

Todd: This thing is going to blow up, man!

WoO: What is the endgame of your site? Do you make any money or act as an affiliate for the entities that you are currently listing?

Todd: I don't make any money off of it right now, but the costs are minimal. Maybe $2 a day. I consider it an investment, it's not my goal to have a website for free, so I am trying to position myself to maybe get a job with one of these entities, or some other type of business relationship.

WoO: Do you think there would be a future in being an affiliate? Ken Murphy of NSIG says he fully expects that there could be as many as 100 entities at some point, so there might be some way that you would get a cut linking people up to entities that are suitable for them and being one of the first resources out there for this specific thing…

Todd: I could maybe see something like that happening. There are a lot of legal questions that haven't been answered yet, so I think acting as some kind of exchange platform if I can figure that out is another possibility. The only thing I know is I think this is going to become big and I want to find a spot for myself somewhere. Whether it is working as a sort of exchange, working directly for an entity or my site takes off in its own right I don't know.

WoO: Do you personally invest in any of these entities right now, if so, which ones?

Todd: I don't bet sports of gamble much at all, really. On a Saturday, I might go to (name of casino intentionally omitted) with some buddies and play a little Blackjack. That's about it, I really don't know much about Sports Betting.

WoO: It seems like many of these entities are showing some positive early returns, do you think that people will eventually gravitate towards them even if they live in Nevada? Relatedly, do you think the Sportsbooks might stomp them out if they are winning too much?

Todd: The way I see it, there are a lot of people that just want action and don't really care what side they are betting, other than betting your favorite team. It makes the game interesting to have action, though, even if you're not actually picking what side your action is on.

WoO: That's especially true if these entities can show a long-term history of winning sooner or later, right? Just speaking for myself, and I pick just slightly above 50% against the spread lifetime but not enough to beat the vig, do I want to trust an entity that wins much more often than they lose, or do I want to trust my idiotic picks?

Todd: (Laughing) I mean, some people just want that juice. You're in on the action, you got action, and in the long-term your action is probably going to win. What else could you want? I think this has the potential to become a very serious form of investing, though, I really believe that some people will have not insubstantial percentages of their portfolios wrapped up in Sports Entities. When it comes to each individual game, though, they let you know that you have made a bet a few minutes after the betting closes, and yeah, now the game is interesting to you.

WoO: Do you think the Sportsbooks will eventually stop taking the action of one entity or the other simply because of how much they are winning?

Todd: The Sportsbooks don't always lose money on the other side, as you know. The main thing that they want is balanced action. I don't think it matters that the entities are on the winning side as long as you have enough money on the losing side, and besides, they might be able to use entity action as something of an indicator that they need to adjust their lines a bit.

WoO: I see what you're saying, kind of like if the books put out a -2.5 Spread for one side and the other side of it is +2.5, if they get $20,000 in bets on each side, then they make money either way and shouldn't really have any immediate reason to care what side is winning, is that what you're saying?

Todd: Right, they don't bet AGAINST entities or against individual bettors, or anything at all along those Lines. They really just want to manage the action and try to adjust it such that they make money no matter what.

WoO: Who has shown the greatest interest in your site so far?

Todd: Some people don't pay attention to Google Analytics, but I do. I see that a lot of my traffic comes from New York and people with interest in Mutual Funds, Hedge Funds and things along those Lines. That's why I think this is going to become a serious form of investment sometimes down the line as long as there are no major scandals or anything along those lines. Some of these returns are insane if they keep going on their present pattern. You just can't do this in the Stock Market short of only owning a handful of positions and getting really lucky, but 20% gains in a three-month period? If some of these entities can continue to do that consistently, to pull those numbers, then I think this is going to become a serious form of investment.

WoO: This is also a way for individuals in states in which Sports Betting is illegal (which comprises most States) to have a legal way to get some skin in the game, do you think that people who simply wish they could bet Sports will find that appealing?

Todd: Like you said, if these entities show a history of winning, then I think people will be better off putting their money with someone who is expected to win. And, again, I really believe that some people don't care what side they are on as long as they have action.

I come from Hawaii, which as you pointed out, has no legalized form of gambling whatsoever. We had one guy's house, though, there were five Poker Tables going. The house wasn't used for anything BUT playing poker, so I think people want to gamble and will gamble even if it is illegal. That said, I think if there are legal alternatives, most people want to stay within the law as much as they can, so they will gamble legally if that is a possibility for them.

WoO: I spoke to Ken Murphy recently who uses the term, 'Investing,' pretty exclusively. He seems to really want to stay away from the word, 'Gambling.'

Todd: Investing is gambling, whether or not Sports Wagering is involved.

WoO: I agree, thanks for the time, Todd, good luck with your site!

___

Another entity is BlueChipsSA.com, which is short for Blue Chips Sports Advisors. Currently, their, 'Performance Fees,' are only 10%, and they require a minimum investment of $1,000 (which they project to eventually raise to $5,000) however they also have, 'Management Fees,' equal to 2% of the Initial Investment, which essentially means that you could lose and still end up paying them 2% on your deposit.

Furthermore, they also lock up an investor's money for one season, so Investors are not free to withdraw at any time they like. The entity states that their expected length of a given investment is two to four years. If there were any specific results (in terms of individual selections) posted on their website, I was not able to find them. The pdf available on their site indicates they are willing to invest anywhere from 0.5%-2% of the total fund depending on how much value they determine they have over the posted line.

This is also an entity that does not seem keen on investing in too many games having gone 13-4 based on what they would have done in both 2014 and 2015 MLB seasons.

Apparently, there are as many as nine such licensed firms available right now, so I will leave you, the reader, to find information on any others on your own should you so choose.

___

Frequently Asked Questions:

Let's jump into a few Frequently Asked Questions that readers may have before we get into some more opinion-related aspects of all of this as well as other information:

1.) Can anyone be an investor?

Answer: Yes and no. Theoretically, anyone from anywhere in the United States or some parts of the world (depending on a country's individual laws) could become an investor. However, the statute behind all of this requires general, 'Know Your Customer,' (KYC) checks into the funds that would be deposited by customers. The reason for this is because Nevada does not want this to be used as a source of money laundering or to enable the use of stolen assets or other peoples identities. In other words, they just want to make sure everyone investing is doing it above the board.

2.) Will I pay taxes?

Answer: If you win, then you will be given an annual statement and you would have to pay taxes on any profits as you would with anything else. Remember, gamblers and investors are actually supposed to file taxes on any profits made gambling, anyway, though as a practical matter, it is true that small-time bettors might not actually have to worry about it.

3.) Is This a, 'Safe,' Investment?

Answer: Essentially, you are investing on your perception that a Sports Betting agency can make positive bets that will generate a positive return on investment for you, so that's a bit of a loaded question. Your funds should generally be considered, 'Safe,' in the sense that there are many compliance Rules in place to ensure proper handling of investors' funds including comprehensive monthly and annual reporting. Furthermore, every entity must be prepared to have a history of all of their bets and results to be presented to the State of Nevada upon request.

In terms of whether or not this is a guaranteed way to make money, absolutely not, you're investing hoping that you can expect to make money, but it is by no means a guarantee.

4.) Will I pay anything if my investments are not successful?

Answer: Sometimes, it depends on the entity. In addition to the losses, just on the entities we looked at above, one entity charges a deposit fee of $50 while another charges a, 'Management Fee,' of 2% of all deposits...though their, 'Performance Fees,' are lower than some others.

5.) Who is Making the Bets?

Answer: The entity is making the bets, but as we have seen in at least a few of the cases the entity only has one what we will call, 'Decision-Maker,' who actually decides what bets are going to be placed on behalf of the investors. In those cases, I think it is fair to say that your investments are only as good as that person is, fortunately, early results indicate that a few of those people are pretty good!

6.) Can I tell the Entity what wagers to make?

Answer: Absolutely not. For one thing, the WIRE Act makes it illegal to transmit Sports Betting information across State Lines, and you cannot legally (individually) bet on Sports unless you are physically present in a state that allows for such. Remember, you are not doing the Sports Betting in this case, the entity is, they are just doing it (in part) with your money. Besides that, even if you could legally discuss what to bet on with them, it would be no small surprise if they didn't listen to you. If you knew as much as they did, then you would do well to just go to Nevada directly and bet the money yourself.

7.) How much money is required to start investing?

Answer: It depends on the entity and can run anywhere from $500-$25,000 as a minimum deposit, though many entities with smaller deposit requirements seem to indicate that they intend to increase the minimums, probably after a season or two of proven results. Furthermore, at least in some cases, multiple individuals can form a partnership, corporation or LLC that itself invests with some of these entities, but all individuals associated therewith will have to be individually approved as investors.

8.) How many entities are there?

Answer: As of the time of this writing, there are nine who are licensed to operate, but it is expected that more licenses will be granted and there will be many more entities to come.

9.) How do I choose an entity that I want investing on my behalf?

Answer: If you choose to invest, that is going to largely be a matter of personal preference and finding an entity that invests in a manner consistent with your personal goals. Some entities will only want to pick a given side of a Line if they perceive themselves as having a tremendous advantage while others may make a larger volume of lower edge picks. Furthermore, many entities only focus on a particular sport or on a few sports, so you can look at the different entities and choose the one that performs the best on the desired sport that you want your money invested on.

In my opinion, I would first look into entities that want very little, if anything at all, in terms of upfront money. I would definitely prefer to stick to entities that, by and large, do not profit unless I profit, so one of those entities that require a 2%, 'Management Fee,' on any monies deposited would seriously concern me. If I made a deposit of $5,000, then they make $100 off of me even if they have the wrong side of every pick.

____

In terms of general concerns, one of my general concerns for investors as well as this relatively young industry as a whole is that a major scandal could cast aspersion on the entire setup. Of course, that is why Gaming is being very careful in awarding licenses to companies to act as entities. All it would take is one serious misappropriation of client funds and people not getting paid when making a withdrawal request pursuant to the Terms to cast the entire industry in a negative light.

There are also concerns about CG Technologies being the only Sportsbook to currently accept entity betting, which means that the entities are limited to one set of Lines. Certainly, the entities would love nothing more than to have a wide variety of Lines from which to choose, but that is not the case right now. As more Sportsbooks (hopefully) accept the bets from Entity groups, then the Entity groups will theoretically become stronger as there is a wider range of Lines that they could theoretically beat.

In and of itself, however, I do not think that suffices to dismiss Equity Wagering out of hand. There is no such thing as the perfect Sportsbook who produces maximally efficient (no advantage lines either way) without fail, so certainly, there will still be some advantageous situations for the Equity firms to bet into. In fact, if we take the results of some of the outfits already operating as being meaningful in any way, then CG Technologies has already released some beatable lines and those lines, in fact, have been beaten.

Furthermore, I believe that it is also important to focus on entities that are as transparent as possible in reporting their results. As has been mentioned in the interviews, winning percentages don't matter (could pick a huge favorite straight up) what matters is how much money is actually won or lost. In the early stages, these entities will have to risk putting their reputations on the line by documenting these short-term results and Variance could work negatively against them because they could go on a, 'Bad run,' which potential investors may take more seriously than it actually is. In that sense, the fundamentals might be in place for winning sides, but the actual results happened to differ in the early going.

The flipside of that coin is that an entity might give the appearance of being stronger than they actually are by performing exceptionally well in the early going. Once again, that might end up being attributable to nothing more than limited sample size, so in that sense, an entity with stronger algorithms or predictive ability might initially have a perceived reputation less than that of an entity that is actually inferior.

It is also true that many entities do not offer much in the way of details as it pertains to their methodology for identifying weak lines, but it may be difficult to do so with any great specificity because, if they tell you exactly how they are making their picks (or offered the source code of their programs for your examination) then the individual investors would be able to just place the bets themselves and cut out the middleman! In that sense, these companies are put into a position in which they have to find a balance between being transparent but also keeping their methods somewhat proprietary.

Conclusion:

While there seem to be some similarities between Entity Wagering and tout services on the surface, I would suggest that there are also a good few differences. For one thing, if I were considering one of these entities to invest my money in, then I am going to focus on those that have negligible entry fees or, 'Management Fees,' if any at all. Any monies paid into these fees would need to be overcome eventually in order for the investor to profit, even after considering the, 'Performance fees.' Another thing that every investor must look at and understand is the structuring of the, 'Performance Fees,' and to what extent could these fees be a sunk cost that is never recouped? Firms such as NSIG, for example, seem as though they are inclined go essentially refund some of these fees in the event of losing quarters given their, 'True up,' mechanism.

As with anything else, it is all a matter of understanding the terms and conditions, understanding what percentage of your investment any initial, 'Deposit Fees,' or, 'Management Fees,' represent and figuring out what the entity would have to do to overcome all of those.

There is certainly some risk in getting in on the ground floor with Equity Wagering because many entities are not going to have a long-term history of results spanning several years attributable to the entity exclusively. However, that also represents an opportunity for early investors, particularly with the entities that currently have lower minimum deposit requirements than some others. What they project to happen is that the results are going to bear out their confidence that they will profit in the long-term, and as that happens, they will be able to command greater minimum deposits, so it is a simple matter of supply-and-demand in that sense.

Significant money has already been invested, though that is surely nothing compared to what will be invested in the event these entities proves to be a success. For example, in that link to the radio interview with Ken Murphy of NSIG, he states that the total invested (as of the time of that recording) was in the mid six figures and he quoted a similar number to me earlier. While $25,000 may represent a significant sum to many of our readers out there, certainly the mid six figures in insignificant to what has been invested in the Stock Market, just as one example.

Of course, if these entities prove viable, then more money will likely be invested as people seek to carve themselves a piece of the high returns. The most cautious thing to do is to wait until several years of results are available and to invest with the entity that you consider the most successful in whatever you would suggest is the, 'Long-Term,' but at that point, you might not be able to get as strong of a deal as you can now.

In addition to the possibility that the minimum deposit requirements are going to increase given a demonstrated history of proven results within an entity, it is also possible that fees can be increased, as well, which could theoretically even include increased, 'Performance Fees,' as a percentage. Think about it: Even if an entity with a near 100% likelihood of showing a profit increased its Performance Fees to 50%, in the event that they are virtually guaranteed to profit over a given amount of time, the investors are all but guaranteed to be making something.

We have looked at two entities that have returned roughly 20% to investors since all of this began, and even if each entity charged 20% of that in fees, if you look at $25,000 getting turned into $30,000 with $1,500 in fees, that is still an actual profit (to the investor) of $3,500 (14% Gain) within just the space of a few months. These entities could theoretically just be running extremely well in the early going, but if there is something at play such that the entities are merely performing, 'As expected,' then those are some very substantial returns.

While this may seem very much like a high-risk, high-return sort of opportunity, interestingly, it's actually not. If you look at a firm with an average investment of 1% on any given side of a Line, and that risk is taken proportionally amongst all investors, then if you have invested $25,000, you actually only have $250 being risked on that side of that particular line. Even in the case of Contrarian, who will risk as much as 5.5% of the overall fund, an individual investor is still looking at a risk of only $1,375 on $25,000 invested on that particular outcome. This may still be too much risk for some people, but in contrast, it may be too little risk for others who would prefer for ALL of their money too directly be doing something at all times.

Access to the money, in liquid form, might also be a consideration for many potential investors, and those investors would do well to look only into funds that allow withdrawals to be done at any time, and preferably without enforcing any sort of penalty.

Regardless of what happens, this is an interesting new concept that we will continue to follow closely at WizardofOdds.com and across the entire LatestCasinoBonuses brand of sites. We look forward to having many pages follow this one in the future. If you have any questions or comments, please refer them, via PM, to Mission146 at WizardofVegas.com or direct any comments to the much smaller associated Article at WoV.